For this post I will share my decision making process where life meets money for the Roper family in summer 2023. My wife Laura and I are big believers in

What can the top 10 largest companies of the past tell us about the future? Read our latest newsletter to see that although market factors may change, the

Last month our blog covered the Secure 2.0 Act with a focus on Americans near or in retirement. However, Secure 2.0 also has some important changes that will

You may remember the Secure Act was signed into law back in 2019 by former President Donald Trump. Building off this legislation, the Secure 2.0 Act was signed

As we reflect back on market performance over 2022, we are ever encouraged to remain steady in a balanced portfolio through whatever 2023 may bring.

Read

This past weekend I had the humbling experience to compete in the 2022 City Tour Championship at Sea Island, Georgia. My partner, Jared, and I competed against

For many years we’ve had the benefit of very low inflation, so cost-wise 2022 was tough on all of us. The flip side to seeing such high inflation is that the

These days we all might need a reminder of the good, the bad, and the ugly that may come along with rising interest rates. Read our latest newsletter for more

Hearing the words "recession" and "inflation" a little too much for your liking? Read our latest Quarterly Newsletter for guidance on why these hot button

Lately, I’ve had quite a few clients contact me with questions on the I-Bond. What exactly is an I-Bond and why is it gaining such popularity? The current

Retirement looks different to everyone, but one commonality is financial independence and the ability to enjoy post-work life. The keys to success start many

Establishing a strong credit history early in your career is important for a number of reasons. A good credit report will typically lead to more favorable terms

As we continue to endure a volatile market environment fueled by multiple economic and geopolitical factors, we wanted to offer some historical perspective we

“Do you see the gap between these two trees? I think I can punch my golf ball between them and have it roll up near the green…”, I suggested to my good friend

While in some ways it may feel like we are living 2020… part II, the 2022 year brings fresh snow along with fresh IRS limitations for retirement plan savings.

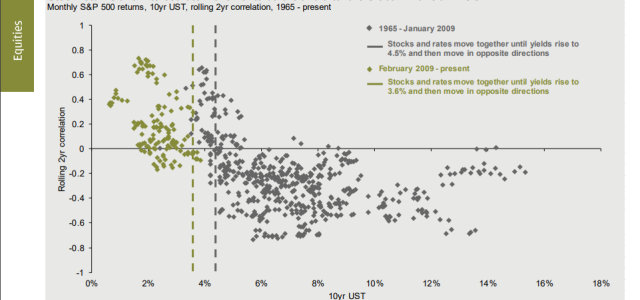

As we enter the new year, will bonds continue to serve their intended purpose in portfolio structure? Check out our latest quarterly newsletter with commentary

As we work our way through the fall and settle into the winter months, we’re getting to the time of year when most people make gifts to charity.

Charitable

How would YOU measure inflation? Our latest newsletter discusses the intricacies of tracking consumer prices while keeping a long-term perspective on the matter

Back in our first blog post, “Reflections with Donald Rembert,” I learned about our decision to go fee-only back in 1983. I also learned that Charles Schwab &

This is one of the hottest topics among my peers, especially given the dramatic rise in demand and housing prices in the D.C. Metro area. Let’s explore both

What do Jimi Hendrix, Bob Marley, and Sonny Bono all have in common? They were all talented musicians – CORRECT! Additionally, they all died without a Will.

Inflation, oh my! Read on for our commentary on growing inflation concerns in the current economic landscape.

A question we Virginia Tech alumni get a lot (and I’m sure our answers vary). If you’ve perused our website, you’ve likely noticed a few VT graduates on the

A friend of mine emailed the other day and was curious about my thoughts on paying down his mortgage as quickly as possible vs. investing that additional money

The relationship between interest rates and equity returns along with the ever present value vs growth debate: our first newsletter of 2021 covers these topics