One phrase the Director of Virginia Tech’s Financial Planning and Wealth Management program frequently used when discussing client recommendations was, “It

...and what a year it has been! Our latest newsletter covers the last quarter of the ride that was 2025. Read more about the overall resilience of our economic

As we wind down 2025, I think we can all agree that it’s been an interesting year in personal finance. We had a substantial pullback in the markets in the

Click below for a replay of our webinar covering the Donor Advised Fund available through DAFgiving360 - links referenced during the webinar are below!

Webinar

When passed in 2022, the Secure Act 2.0 introduced sweeping reforms to numerous tax issues. On September 16th, 2025, final regulations on the planned

On any given day you can come across a major success story in the markets. An investor managed to get in and out of the market at the perfect time. They bought

What comes to mind when people think of retirement? For most, they are drawn to the financial aspects. Do I have enough? How much can I spend? Who should I

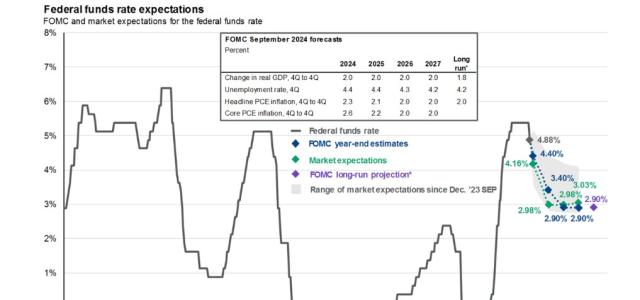

The delicate balancing act of the Federal Reserve continues as outlooks remain favorable for the US economy despite slowing... details in this quarter's

Wishing you joyful journeys both near and far... happy summer from RPJ!

Trade talks and tariffs contribute to turbulent times... read more in our second quarter newsletter written by our brand new Director of Investments, Jeff

Rembert Pendleton Jackson congratulates Liz Verdi on her nominations as a “Top Financial Professional” in Northern Virginia Magazine and a “Top Financial

For the last four years or so, I have had the pleasure of working for one of the large federal consulting firms in the DC area. Growing up outside of DC always

My husband and I are lucky. We purchased our home in 2020, financed our mortgage through Sandy Spring Bank with a killer rate (2.5%) and now… we can never leave

My friends, it’s that time of year again. As we wrap up 2024, and look around the corner at the New Year, the folks at the IRS have re-set the annual limits

Rate cuts: read what they mean for the economy and your portfolio in our latest Quarterly Newsletter below...

Buying a car can be a significant financial undertaking. Back in college, I was headed home for the holidays when my drive took an unexpected and unfortunate

We experience it every year... the lull of sweet summertime. Finances aren't always top of mind with children home from school and vacations in full swing. We

Today, it has never been easier to find content on personal finance. With social media’s ever-growing popularity and influence amongst the youth, social media

As comprehensive financial planners, we at RPJ are constantly reviewing portfolios and tracking our client’s Net Worth. In the last few years, we have seen

We were lucky to have Marjorie Brown from McGinn and Company interview Don to learn more about his role as a thought-leader within our industry. Please join us

One of the Roth IRA’s biggest benefits is tax-free withdrawal of money in retirement. When I bring this up to clients and friends, many know about this

Markets are up and an election year is upon us... read more about the current interest rate environment and discover a surprising statistic in our Q1 newsletter

According to WalletHub, 84% of the US adult population owned at least one credit card in 2022. So, the magic question is… What makes this product so popular

With a bit of commentary on US debt, our latest newsletter covers the upswing a strong end of 2023 allowed markets. Read more on various sector performance

My friends, it’s that time of year again. Fall is in the air, daylight savings has ended, and the folks at the IRS have reviewed inflation numbers and have re