Tapping Your Home Equity

My husband and I are lucky. We purchased our home in 2020, financed our mortgage through Sandy Spring Bank with a killer rate (2.5%) and now… we can never leave our home!

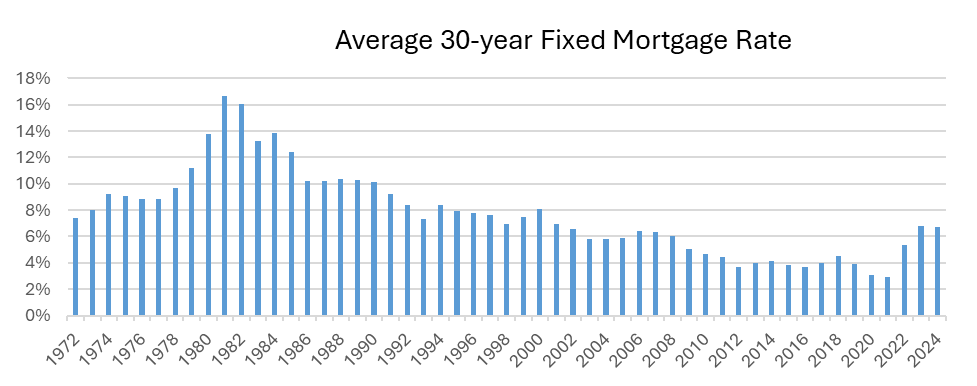

Having been in this business for over 20 years, I know that a 2.5% mortgage rate is insane. If you asked my Dad, he might say that a 6% mortgage rate is also pretty great. And if you asked HIS Dad (you’d have to have a séance), he might tell you about how his retirement CDs paid 13% interest. Fluctuating rates impact everything from individual home loans to larger economic forces like inflation and market cycles.

With the equity we’ve been lucky enough to build, combined with the golden handcuffs of a 2.5% mortgage rate, we explored another option for upgrading our home: a home equity line of credit (HELOC). And we were not alone! HELOC debt nationwide increased by 7.2% in 2024, which is not surprising as tappable home equity approached $12 trillion going into 2025.

A home equity line of credit is simply a set amount of credit you can draw against the equity in your home. The specific terms, like interest rates and how you pay it back, will differ, but the core concept is being able to use that money for whatever you need. We also explored the idea of a home equity loan – which only differs from a HELOC in that is includes a set withdrawal amount with fixed payment terms (both rate and payments).

Many people tap into their home equity for renovations, but it's also commonly used for things like consolidating debt, covering educational costs, or funding significant purchases. In this sense, a HELOC can act as an extra layer of financial security, available after you've utilized your primary emergency savings. The HELOC rates usually vary based on the prime rate, though some banks do offer a fixed rate option for repayment.

Another added benefit: for tax years 2018 through 2025, if home equity loans or lines of credit secured by your main home or second home are used to buy, build, or substantially improve the residence, interest you pay on the borrowed funds is classified as home acquisition debt and may be deductible, subject to certain dollar limitations. However, interest on the same debt used to pay personal living expenses, such as credit card debts, is not deductible.

Ultimately, we decided on the HELOC and have since drawn funds to complete a partial basement renovation… and the list of dream house renovation projects continues to grow!

Sources:

Historical mortgage rates: 1971 to the present

HELOC Balances Surpass $45,000 in 2024