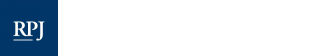

Rate cuts: read what they mean for the economy and your portfolio in our latest Quarterly Newsletter below...

Markets are up and an election year is upon us... read more about the current interest rate environment and discover a surprising statistic in our Q1 newsletter

With a bit of commentary on US debt, our latest newsletter covers the upswing a strong end of 2023 allowed markets. Read more on various sector performance

What can the top 10 largest companies of the past tell us about the future? Read our latest newsletter to see that although market factors may change, the

As we reflect back on market performance over 2022, we are ever encouraged to remain steady in a balanced portfolio through whatever 2023 may bring.

Read

These days we all might need a reminder of the good, the bad, and the ugly that may come along with rising interest rates. Read our latest newsletter for more

Hearing the words "recession" and "inflation" a little too much for your liking? Read our latest Quarterly Newsletter for guidance on why these hot button