Household Employee Taxes: Pod Learning Edition

According to the United States Census Bureau (August 2020), over 90% of households with school aged children were enrolled in some form of distance learning to start the 2020-2021 school year. While we all want to keep our families safe from this horrible virus, we must maneuver through the logistics of having our children at home. If there’s one thing I learned from the Spring semester, I’m no homeschool teacher. My children agree. Like most parents, I went to the internet for options. Perhaps we could utilize School Age Child Care (SACC - Fairfax’s before/afterschool program), or a day camp, or a learning pod? Having only heard of these so-called “pods”, I googled my way through the logistics and our three-family pod was created. Three families, five kids, one teacher, alternating houses week by week.

Our first step was hiring someone to help guide our pod. We found Ms. Kim and she’s AMAZING! Our next step, discuss how to pay her with regards to taxes. Under the table? No, that’s illegal. 1099? No, she’s not a consultant. W-2 household employee? YES, that’s correct! Kim is considered a household employee under the eyes of the IRS and taxes should be withheld as such. There are many companies that will file the taxes for you, obviously for a cost. We figured it was most appropriate to tackle this ourselves and save some pennies.

A few facts and recommended steps with regards to Household employees and taxes – all facts come from the IRS Publication 926 – Household employer’s Tax Guide1.

- You will need to establish a Federal EIN. https://sa.www4.irs.gov/modiein/individual/legal-structure.jsp

- You do not have to withhold household employee federal/state paid taxes on their behalf, although it’s a nice gesture. If the employee requests withholding, be sure to use the redesigned W-4 found on the IRS website: https://www.irs.gov/pub/irs-pdf/fw4.pdf

- Social security and Medicare taxes apply if you pay the household employee more than $2,200 in a tax year. Both employer AND employee Social Security (6.2%) and Medicare (1.45%) taxes apply[AL1] 1.

- Federal Unemployment taxes (FUTA) are also applicable if you pay your employee more than $1,000 for any quarter. The cap on this tax is $420/year[AL2] 1.

- You may report the above items 2-4, quarterly, using Form 941 (https://www.irs.gov/pub/irs-pdf/f941.pdf) or annually using Schedule H, which is currently being updated with a 2020 version. We prefer to submit quarterly to stay ahead of the payments.

- Register your EIN with the Social Security Administration using their Business Services Online website: https://www.ssa.gov/bso/bsowelcome.htm This website is used for creating W-2 and W-3s.

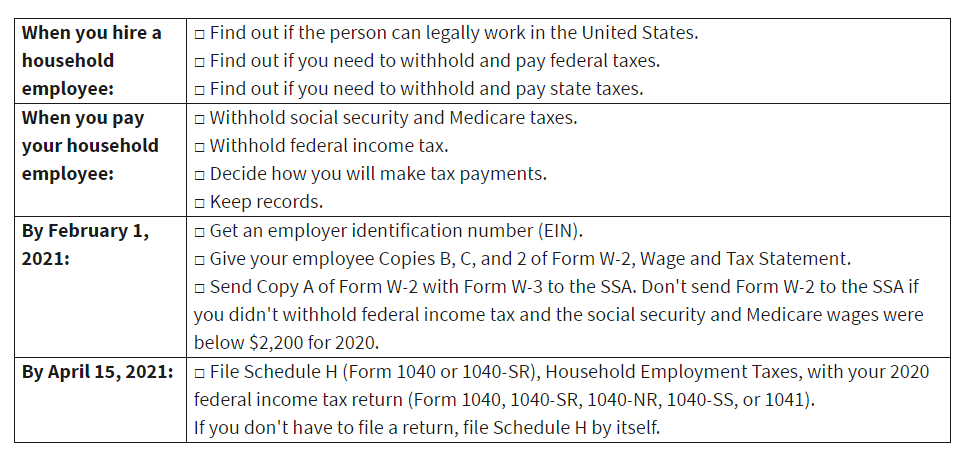

- You must file Forms W-2 and W-3 by February 1, 2021. Penalties may apply if filing is not done on time! Here’s a nice checklist directly from IRS Publication 9261.

- State taxes and unemployment submissions vary. Virginia requires you to submit wages to the Virginia Employment Commission (VEC) on a quarterly basis and submit the necessary unemployment taxes at that time. I’ll hold off on those logistics… see your state website for more details. Virginia: https://www.vec.virginia.gov/employers/faqs/Employer-UI-Tax-Questions)

Below is an example of a $1,000 gross pay – I’m using this figure for easy math. Please note, the employer actually pays $1,161.50 because of the applicable employer taxes (SS, Medicare, FUTA and State Unemployment).

| Gross Earnings | $1,000.00 |

| Employee Paid Taxes | |

| Federal Withholding | $87.64 |

| State Withholding | $47.00 |

| Employee Social Security (6.2%) | $62.00 |

| Employee Medicare (1.45%) | $14.50 |

| Total Deductions | $211.14 |

| NET PAY | $788.86 |

| Employer Paid Taxes | |

| Employee Social Security (6.2%) | $62.00 |

| Employee Medicare (1.45%) | $14.50 |

| FUTA (6%- $420/max annually) | $60.00 |

| State Unemployment (2.5%) | $25.00 |

| Total Employer Paid Taxes | $161.50 |

Clearly there are loads of numbers here and filing the necessary taxes and documents is not in the cards for every household employer… but it can be done! In closing, I’ll give my standard disclosure with regards to tax advice, please confirm these details with your accountant or tax preparer. In my family’s case, that’s me.

Last note: The pod is thriving, Kim is amazing and the kids love having some social interaction other than through a computer. Meanwhile, we parents are still engaged in our children’s virtual schooling while working full-time and attempting to keep our sanity…or what’s left of it.

This is what virtual learning looks like in my house!

(1) https://www.irs.gov/publications/p926

Disclosures:

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for tax, legal, or individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own.

Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. We have not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to Rembert Pendleton Jackson.