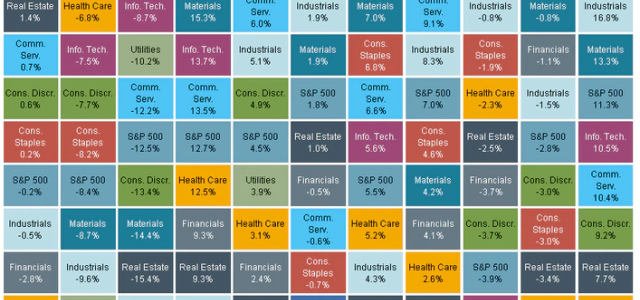

As we reflect back on market performance over 2022, we are ever encouraged to remain steady in a balanced portfolio through whatever 2023 may bring.

Read

These days we all might need a reminder of the good, the bad, and the ugly that may come along with rising interest rates. Read our latest newsletter for more

Hearing the words "recession" and "inflation" a little too much for your liking? Read our latest Quarterly Newsletter for guidance on why these hot button

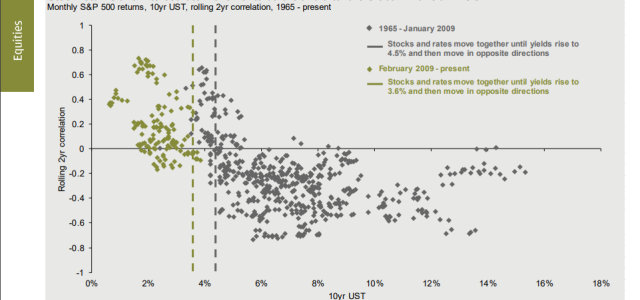

As we enter the new year, will bonds continue to serve their intended purpose in portfolio structure? Check out our latest quarterly newsletter with commentary

How would YOU measure inflation? Our latest newsletter discusses the intricacies of tracking consumer prices while keeping a long-term perspective on the matter

Inflation, oh my! Read on for our commentary on growing inflation concerns in the current economic landscape.

The relationship between interest rates and equity returns along with the ever present value vs growth debate: our first newsletter of 2021 covers these topics

Reflecting back on the uniquely challenging year, 2020's last quarterly newsletter highlights the ever present investment philosophy proving diversification is

Uncertainty looms as we continue to navigate the COVID-19 pandemic. As the world around us continues to change, we share what we believe will always stay the

How differentiating short-term cash needs can help you stay on course during these turbulent times.

Coronavirus has life as we know it screeching to a half - read on for how diversification can help soften extreme market movement.