...and what a year it has been! Our latest newsletter covers the last quarter of the ride that was 2025. Read more about the overall resilience of our economic

The delicate balancing act of the Federal Reserve continues as outlooks remain favorable for the US economy despite slowing... details in this quarter's

Trade talks and tariffs contribute to turbulent times... read more in our second quarter newsletter written by our brand new Director of Investments, Jeff

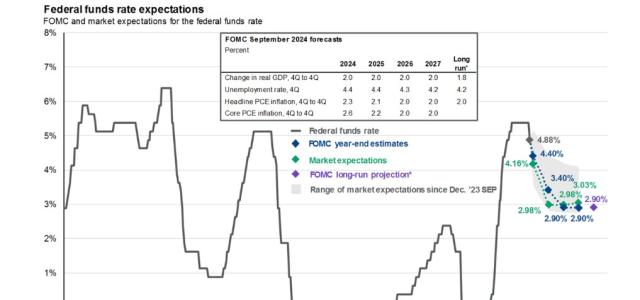

Rate cuts: read what they mean for the economy and your portfolio in our latest Quarterly Newsletter below...

Markets are up and an election year is upon us... read more about the current interest rate environment and discover a surprising statistic in our Q1 newsletter

With a bit of commentary on US debt, our latest newsletter covers the upswing a strong end of 2023 allowed markets. Read more on various sector performance

What can the top 10 largest companies of the past tell us about the future? Read our latest newsletter to see that although market factors may change, the