The Pysche of Retirement

What comes to mind when people think of retirement? For most, they are drawn to the financial aspects. Do I have enough? How much can I spend? Who should I leave money to? While much attention is given to financial readiness, increasing trends of life expectancy in retirement have compelled practitioners to view retirement as a holistic approach that must incorporate financial, emotional, social, and psychological needs.

Psychological Challenges in Retirement

As many gear up for this new phase of life, retirees face a plethora of psychological hurdles, both imminent and gradual along the way.

Loss of work identity and sense of purpose

Increased unstructured time

Changes in routines

The aging process and changes in health

How stressful can the transition be? In 1967, psychiatrists Thomas Holmes and Richard Rahe developed the Social Readjustment Rating Scale after examining the responses of over 5,000 medical patients to determine whether stress from sudden life-changing events led to illnesses. They ranked retirement from work as the tenth most stressful event out of 43 life events.

Preparing for a transition of this magnitude requires developing a lifestyle framework that seeks to find purpose, maintain relationships, nurtures health, and balances leisure and productive activities.

Developing a Well-Being Framework

While indulging in all things golf or high tea whenever, wherever sounds amazing in retirement, a singular activity will likely not hold up for the entirety. So how can you plan for a meaningful retirement?

Advancements in behavioral finance have created some useful frameworks:

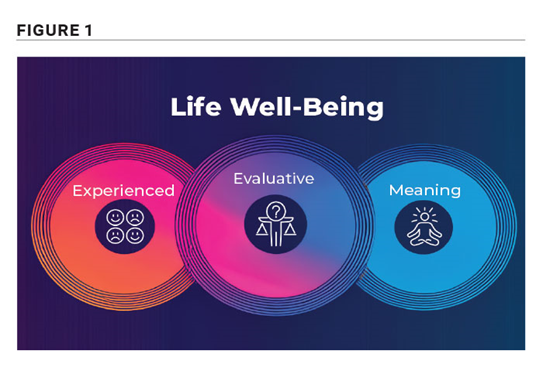

The Life Well-Being framework can be thought of as a top-down approach that seeks to answer the “Why?” in retirement.

Evaluative Well-Being – Enables a retiree to reflect on their past achievements, evaluate how well their personal goals have been met, and can be the fuel to reconfigure their good work in retirement. Ex. A retired advisor now teaches personal finance to kids.

Experienced Well-Being – This evaluation grounds the retiree. It requires them to truly assess how they are feeling day-to-day in retirement. Ex. Journaling can allow a retiree to truly express their feelings and track their mood over time.

Meaning Well-Being – This refers to the sense of purpose and meaning individuals derive from their lives. The retiree’s mindset shifts from career accomplishments to more personal pursuits. Ex. Aspirations to spend more time with family and in community.

Get-A-Life Tree

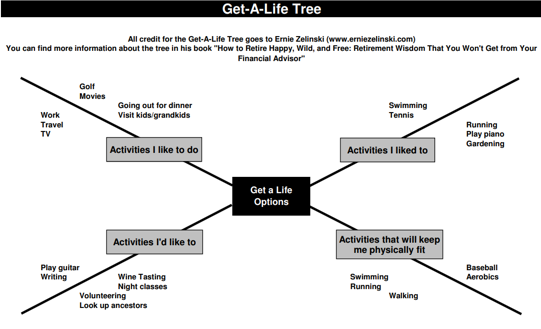

After a retiree successfully identifies their “Why?” in retirement, building a framework like the Get-A-Life Tree created by author Ernie Zelinski can answer the “How?”

While financial stability plays a key role in retirement, there are a growing number of studies that link healthy retirements with the balancing act of financial and psychological needs.

Sources: https://www.erniezelinski.com/